End of FY Tax Tips

Bathroom Repairs, Maintenance and ImprovementsTax tips for bathroom, repairs, maintenance and improvements

If you own a rental property, you’ll know first-hand how many expenses investors need to shoulder to keep your properties in good condition and at high occupancy. Keeping a property in good condition is simply a requirement for good business. After all, who wants to live in a place with faulty utilities or filthy or leaking bathrooms?

Like any income stream, renting out a property carries with it a number of tax benefits. There are many ways for you to offset your yearly tax bill and claim back what’s rightfully yours. You just need to know where to look and how the ATO classifies the work you’re considering doing to your property.

What can landlords claim?

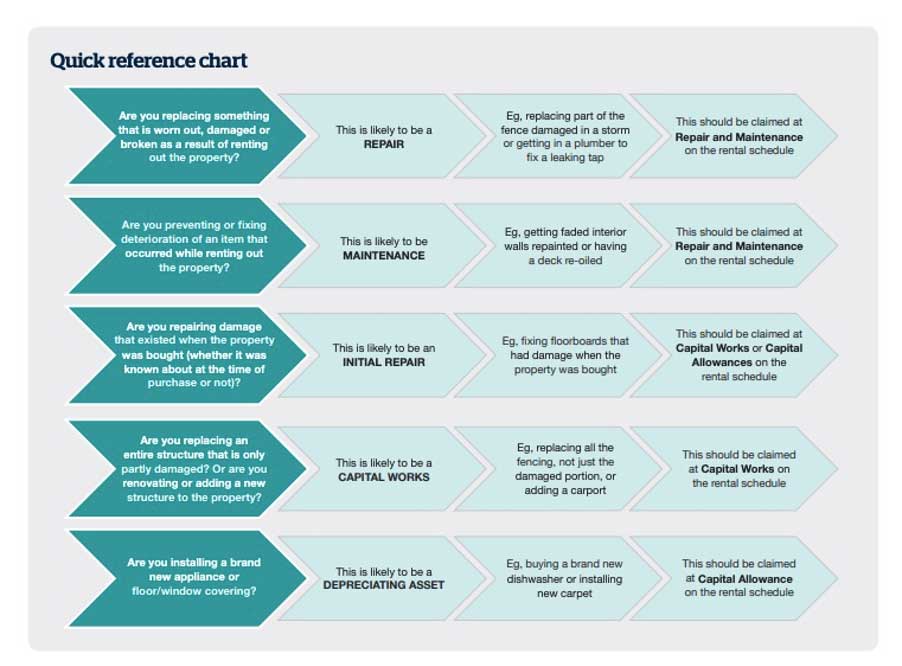

Repairs, maintenance and improvements are the three main categories the ATO allows you to claim or deduct on;

(Image Source: ato.gov.au www.ato.gov.au/uploadedFiles/Content/IND/Downloads/TaxTimeToolkit_Rental-repairs.pdf)

Repairs

Generally, repairs must relate directly to wear and tear or other damage that occurred as a result of your renting out the property. It does not relate to any works that improve a part of the property. That would be considered “Capital Works”.

For example, if you decided to replace the damaged vanity to a different style and upgraded the plumbing to a flick mixer style tap, this would be considered an improvement and would be handled differently by the ATO.

Shower Dr Sunshine Coast Repair Services:

-

- Leaking Shower Service: A Shower Dr leaking shower service includes removing and replacing all grouts and silicones from the shower or bathroom area, installing 100% waterproof epoxy grout and silicones completely sealing any leaks and restoring the shower to like new condition.

-

- Bathroom Rejuvenation Service: The Shower Dr bathroom rejuvenation service is the same service as the above-mentioned Shower Service only extended to the entire bathroom. All grouts and silicones are replaced, epoxy grout installed on your bathroom floor and completely resealing the entire room with fresh silicones, leaving your bathroom looking brand new and with no leaks.

-

- Shower Base Rebuild: If the structural integrity and waterproofing system of the shower or bathroom is compromised and water has penetrated through the waterproofing into the shower substrate and damaged framing and sheeting, a Shower Base rebuild is likely the minimum level of repair required to fix this issue.

A Shower Base Rebuild includes completely removing all tiles, sheeting, framing and waterproofing from the bottom 3rd of the shower recess. We then completely reconstruct the shower base with new sheeting, framing, bedding and waterproofing. Once the new base is constructed, we install tiles that match the existing floor and wall tiles throughout the rest of the bathroom, completely restoring the shower to its original condition.

- Shower Base Rebuild: If the structural integrity and waterproofing system of the shower or bathroom is compromised and water has penetrated through the waterproofing into the shower substrate and damaged framing and sheeting, a Shower Base rebuild is likely the minimum level of repair required to fix this issue.

Maintenance

Maintenance is any work carried out to prevent deterioration or fix existing deterioration. This could include things like painting, cleaning, replacing deteriorating of failing grout, bathroom mould removal or replacing bathroom silicones.

Work carried out to prevent or fix deterioration that takes place as a direct result of the property being tenanted can be claimed for the tax year in which it occurred.

Shower Dr Sunshine CoastMaintenance Services:

-

- Bathroom Inspection & Leak Detection Report: The first step to maintaining your property is knowing what condition its really in. The Shower Dr Sunshine Coast offers a state-of-the-art leak detection and bathroom inspection report carried out by a fully qualified, QBCC licensed builder that specialises in bathroom repairs and maintenance. You’ll know well in advance what maintenance is needed in your bathroom, allowing you to get on the front foot and plan your repairs for when they best suit you financially and before the any defects turn into serious damage.

-

- Shower Service: A Shower Dr shower service includes removing and replacing all grouts and silicones from the shower or bathroom area, installing 100% waterproof epoxy grout and silicones, completely sealing any leaks and restoring the shower to like new condition.

-

- Bathroom Rejuvenation Service: The Shower Dr bathroom rejuvenation service is the same service as the above-mentioned Shower Service only extended to the entire bathroom. All grouts and silicones are replaced, epoxy grout installed on your bathroom floor and completely resealing the entire room with fresh silicones, leaving your bathroom looking brand new and with no leaks.

-

- Mould Removal Service: Some bathrooms just can’t be cleaned. No matter how hard you scrub, the mould keeps coming back. Would you leave a bathroom with reoccurring mould problems up to a tenant to keep clean? The Shower Dr Mould Treatment service chemically removes the source of the mould and restores the area to like new condition, making it much easier to keep clean.

Depreciation

Deductions for depreciation are applied to assets within the property that decline in value over time. These assets that are assumed to have a limited effective life, such as, carpets, bathroom fittings, grout, silicones, tiles, waterproofing, curtains, appliances and furniture.

Capital works deductions

Capital works deductions are income tax deductions that can be claimed for the expenses such as:

- building construction costs

- the cost of altering a building

- the cost of capital improvements to the surrounding property.

Some examples include major renovations to a room, adding a fence or retaining wall, building extensions such as garages or patios and adding structural improvements like a driveway or retaining wall. The rate of deduction for this is generally 2.5% per year for 40 years following construction.

Repairs before renting

Any repairs on defects that existed when you obtained the property are not deductible if they are carried out before the property is rented. This applies even if the repairs were carried out to make the property suitable for tenants.

Replacements

If you have to entirely replace an item, the ATO does not consider this a repair. You would not be able to deduct the entire replacement cost, but you might be able to claim the replacement as a capital works deduction or a depreciating asset.

What do you need to provide?

If you want to apply for a private ruling about the deductions you can claim for a rental property, you need to provide the supporting information listed below;

- The property’s rental income

- The deductible expenses you pay

- All costs of purchasing and acquiring the property

- Conveyancing contracts

- All loan documentation

Hurry, it’s tax time!

You only have until 30th June to complete your repairs, maintenance or improvements. If you’d like to have a chat with a licensed builder, give us a call and we’ll set you in the right direction.

Call The Shower Dr Sunshine Coast on 07 5491 4458 and let us help you keep your family safe.

Disclaimer: We are not financial advisors and encourage everyone to do their own independent research before making any financial decisions. The following information has been sourced from the ATO website. You can read more here – https://www.ato.gov.au/general/property/residential-rental-properties/rental-expenses-to-claim/

What our customers say

Get a Free Quote

Contact Us

Links

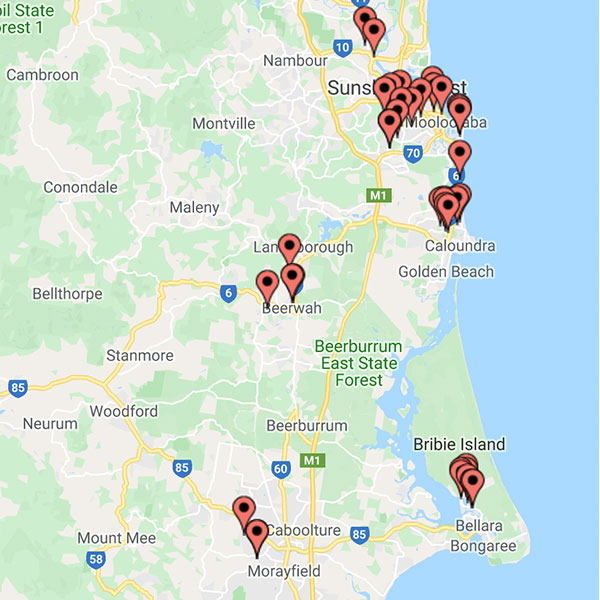

Servicing

All Sunshine Coast Suburbs

North Brisbane

Moreton Bay Region

Caboolture

North Lakes

Nambour

Caloundra

Noosa

Redcliffe

Click on the map to see where we've recently repaired showers for our customers